Great news for homebuyers! The Federal Housing Finance Agency (FHFA) has announced increased conforming loan limits for 2024. This means you can now borrow more under a conventional mortgage, making…

Month: September 2024

Interest Rate Drop: What It Means for Your Mortgage – Now is the Time to Act!

Great news for homebuyers and homeowners! Recent changes in the market have led to a drop in interest rates, and this could be the perfect time to either purchase your…

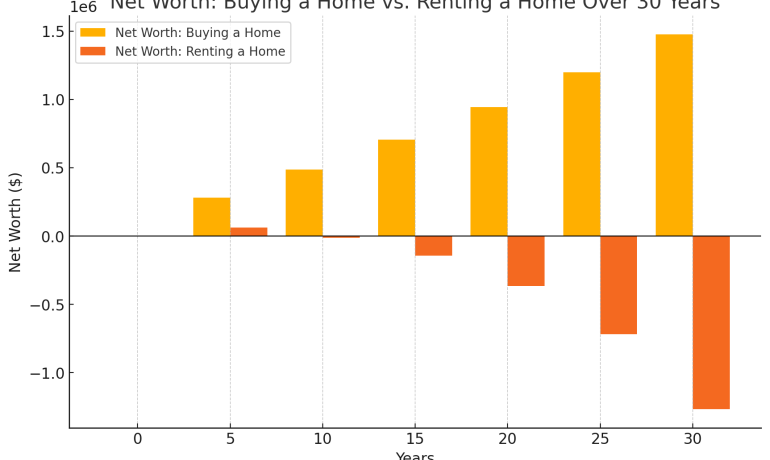

Net Worth: Buying A Home Vs. Renting A Home Over 30 Yrs

Above: The updated bar graph illustrates the net worth of an individual over 30 years when choosing to buy a home versus renting. This comparison shows how the net worth…

in Alternative Mortgages, Conventional Mortgage, FHA Mortgage, First-Time Home Buyer, Mortgage Loan Originator0by aTornado@524

421

September 2024 Mortgage Rate Update: What’s Happened Over the Last Month and What to Expect Next

Over the past month, we’ve seen some interesting movements in mortgage rates. As anticipated, the rates have slightly decreased, and it’s important to note that the expected 0.25% rate drop…

in Community, Conventional Mortgage, Down Payment Assistance Programs, FHA Mortgage, First-Time Home Buyer, Mortgage Loan Originator0by aTornado@524

436

Hometown Heroes Program Update: Funds Depleted—Alternative Home Financing Options Available!

We wanted to provide you with an important update regarding the Hometown Heroes Program. Unfortunately, this program has run out of funds. While there is a possibility that some funds…