Condo Association questionnaire have been around for quite some time in the mortgage lending industry. This is because when you are financing a condo unit the lender needs to know the association’s health.

In other words, when you are purchasing any other type of property like a single-family home or town home (where the lot is included in the sale) i.e., that’s not a condo, the lender checks to see the health of the property and that of the borrower(s) to approve the mortgage.

With a condo, where the land is not included in the sale, the association becomes the 3rd entity that the lender needs to checked to see if it’s healthy. Also keep in mind that there are some condominiums that have more than one association and or special assessments.

Special assessments are a tell-tale sign that it has very little or no reserves and therefore to make repairs it has to ask for additional funds from the owners of the units in order to complete the work and is one of the primary reasons for the lender not to approved the association. Believe it or not there are ways to still get financing for some condos that have some of these issues.

Condominium buyers usually benefit from less maintenance on their properties since everything from the walls out is usually maintained by the association. Most condominiums offer amenities like gyms and/or pool, security and a community with in the community feeling. This all works as long as the association is healthy. With an unhealthy association, you be able to see deterioration and so will the lender. Condominium living is not for everyone, but with property prices being so high it’s definitely becoming more attractive to more buyers.

One thing you should keep in mind, is that the association charges a fee to complete the questionnaire and provide the additional needed documents to get a conditional loan approval. In certain cases where the associations are not healthy, the lender will not lend and the buyer loses the funds she/he paid for these documents to the association. These fees vary from association to association but the range I have seen is from $75.00 to $850.00.

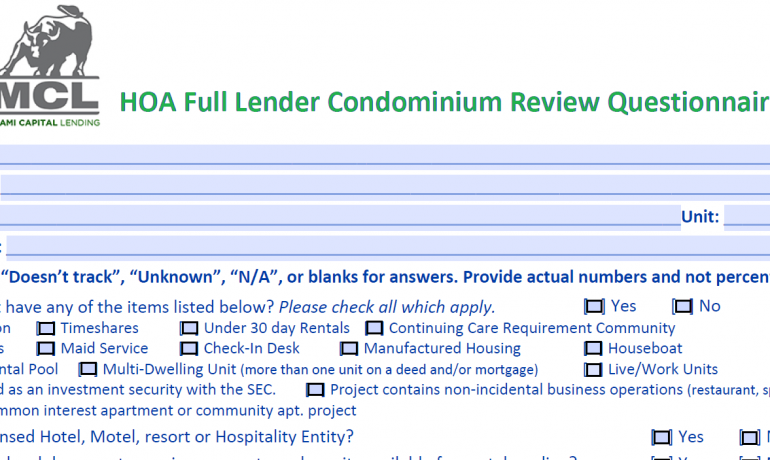

There are many criteria the lender is looking for when reviewing the completed questionnaire. To name a few:

- Monetary Reserves

- Adequate Insurance coverage

- Percentage of non-owner-occupied (rented) units in the association

- If there’s any litigation with said association

But recently most lenders have added up to four additional questions to their questionnaires.

- In the last six months of the project’s HOA meetings has there been any discussion about maintenance or construction that may have significant safety, soundness, structural integrity, or habitability impacts on the unit or the project? If yes, please provide details about the issues/concerns or HOA minutes for last 6 months.

- Are there any available inspection, engineering, or other certification reports completed within the past five years to identify deferred maintenance that may need to be addressed? If yes, please provide a copy of the reports.

- Does the project have significant deferred maintenance, received a directive from a regulatory authority or inspection agency to make repairs due to unsafe conditions or failed to obtain an acceptable certificate of occupancy or pass local regulatory inspections or re-certifications?

- Are there any current or planned special assessment? If yes, provide the reason for the special assessment; the total amount assessed, the total amount per unit assessed and repayment terms; documentation to support no negative impact to the financial stability, viability, condition, and marketability of the project and documents necessary to confirm the association has the ability to fund any repairs.

These questions, will make condo financing a little more challenging in every aspect of the word. From the amount of paperwork requested from the HOA along with the questionnaire to the amount of fees to be able to obtain the needed paperwork. Also, in the event of a future special assessment the lender will add it to the borrowers DTI that can affected the borrower negatively. In the end, I see fewer people will be able to afford the condominiums.

If you are in the marker for a condominium and want to limit the condo questionnaire fee, reach out to MCL at 786 622-2224 and ask about our assistance for condo questionnaire and part of your condo questionnaire fee will be covered by the lender. You can also submit your application for the purchase of your condo by clicking here.