The average interest on a 30-year fixed-rate mortgage climbed to 3.09% on Tuesday, according to Yahoo Finance. That’s up from 2.88% a week ago.

Mortgage rates are inversely tied to the yield, or interest, on the 10-year Treasury note. That yield has been rising in recent weeks over worries that stronger economic growth, fueled by COVID-19 vaccines and more stimulus from Congress, will lead to inflation.

Inflation is the bond investor’s worst enemy, because it erodes the value of those fixed payments that a bond holder receives over time. Bond investors demand higher yields to compensate for that.

Even though the uptick in rates, mortgage rates are still ridiculously low, historically speaking.

“Even if they were 3.4, even if they were 3.9, that’s still very low,” said Doris Schaper, our Senior Mortgage Processor with Miami Capital Lending in Florida.

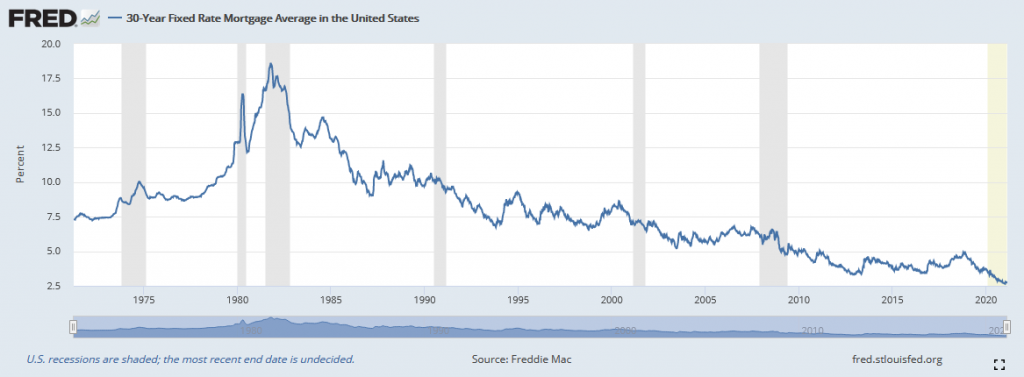

A decade ago, the average on a 30-year fixed was about 5% — and a decade before that, about 7%.

A chart from the Federal Reserve Bank of St. Louis shows 30-year mortgage interest rates over time, as tracked by Freddie Mac.

The Federal Reserve has some sway over mortgage rates, too. The central bank has been buying Treasury and mortgage bonds to help keep rates low and hasn’t signaled any plans to pull back.

The Federal Reserve recognizes that housing has been a significant contributor to economic recovery, and the last thing though they want to do is to choke that off.

In the meantime, even the slight uptick has some existing homeowners scrambling to refinance.

“Servia Ramirez, a Mortgage Broker with MCL said that her borrowers are telling her, ‘I heard in the news that rates are going up! What can you do for me, or is it too late?’”.

Brokers say it’s not enough to dampen demand for new mortgages in a hot housing market although an increase in rates may slow down refinancing.

“What I hear from the boots on the ground in South Florida from Key West to Stanford which is north east of Orlando and on the west side of Florida all the way up to the Panhandle, is that the purchase business is booming all over the state,” Servia said. “There’s a shortage of inventory, and people are fighting over homes.”

Its still not too late to get your refinancing done! Make an appointment below.

How Can We

Help You?

To discuss how our team can help you in the home buying or refinancing process.