Las Tasas Hipotecarias Bajan Levemente por Segunda Semana Consecutiva, Pero Se Mantienen Justo por Debajo del 7%

The average 30-year mortgage rate in the U.S. has declined for the second consecutive week, offering a minor reprieve for…

Cómo Programar una Cita en Nuestro Sitio Web

Ensuring a Smooth Booking Experience for You At MIAMI CAPITAL Lending, we value your time and feedback! Based on customer…

¡Obtén Financiamiento del 100% para Compradores de Vivienda por Primera Vez – Tu Camino hacia la Propiedad Comienza Aquí!

Are you searching for first-time homebuyer programs with 100% financing? Look no further! Buying your first home is an exciting…

Comprendiendo los Requisitos de Reserva para Condominios en Florida en 2025: Lo que las Asociaciones y Propietarios Deben Saber

Effective January 1, 2025, Florida condominium associations are mandated to establish and maintain reserve funds specifically allocated for the repair…

Cambios en la Ley de Condominios de Florida en 2025: Nuevos Requisitos de Seguridad y Transparencia para las Asociaciones

In response to the tragic collapse of the Champlain Towers South in Surfside, Florida, in 2021, the state has enacted…

Programa de Compra con Cero de Enganche Ofrecido por MCL

The Zero Down Purchase program by MIAMI CAPITAL Lending LLC (MCL) provides a 3% down payment assistance loan, up to…

MIAMI CAPITAL Lending LLC Ahora Ofrece Exenciones de Depósito en Garantía sin Costo en Préstamos Convencionales con LTV de Hasta el 97%

MIAMI CAPITAL Lending LLC (MCL) is pleased to announce a new benefit for clients: no-cost escrow waivers on conventional loans…

Últimas Noticias: ¡Nuevos Límites de Préstamos Conformes para 2024!

Great news for homebuyers! The Federal Housing Finance Agency (FHFA) has announced increased conforming loan limits for 2024. This means…

Bajada de Tasas de Interés: Qué Significa para tu Hipoteca – ¡Es el Momento de Actuar!

Great news for homebuyers and homeowners! Recent changes in the market have led to a drop in interest rates, and…

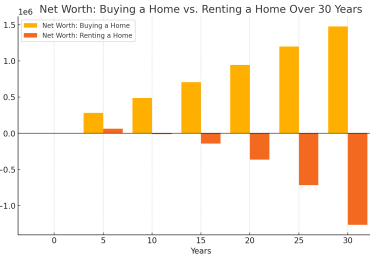

Patrimonio Neto: Comprar una Casa vs. Alquilar una Casa Durante 30 Años

Above: The updated bar graph illustrates the net worth of an individual over 30 years when choosing to buy a…

Actualización de Tasas Hipotecarias septiembre 2024: Lo Que Ha Sucedido en el Último Mes y Qué Esperar a Continuación

Over the past month, we’ve seen some interesting movements in mortgage rates. As anticipated, the rates have slightly decreased, and…

Actualización del Programa Hometown Heroes: Fondos Agotados—¡Opciones Alternativas de Financiamiento para Vivienda Disponibles!

We wanted to provide you with an important update regarding the Hometown Heroes Program. Unfortunately, this program has run out…

Oportunidades Emocionantes para Financiar Propiedad de Vivienda con MIAMI CAPITAL Lending LLC

At MIAMI CAPITAL Lending LLC, we are dedicated to helping you achieve your dream of home ownership in Florida. We…

Foreign National Mortgage Program

Investing in property overseas can be an exciting endeavor, offering the chance to diversify your investment portfolio, enjoy a holiday…

Use Retirement Income to Purchase a Home

Retiring from work doesn’t mean you can’t achieve your dream of homeownership. Whether you’re receiving a steady income stream, taking…

Refinancing from a Private Mortgage to a Conventional Loan

Misconceptions about private mortgages often arise from inadequate advice or a lack of knowledge and guidance. Many individuals find themselves…

Fannie Mae's HomeReady & Special Purpose Credit Program

Fannie Mae’s HomeReady program and the Special Purpose Credit Program (SPCP) offer significant assistance to first-time homebuyers, making the dream…

Comprendiendo el Programa Hometown Heroes en Florida

Introduction: The Hometown Heroes Program is an initiative aimed at making homeownership in Florida more accessible for eligible workers, particularly…

Las tasas hipotecarias caen por debajo del siete porciento: Un análisis detallado del cambio de mercado

In a welcome turn for prospective homeowners and those considering refinancing, mortgage rates have dipped below the 7% threshold, as…

Fannie Mae Actualiza Directrices para Propiedades en Bienes Raíces Poseídas: Lo que Debes Saber

Fannie Mae, one of the leading entities in the mortgage and housing industry, has recently introduced significant updates to its…