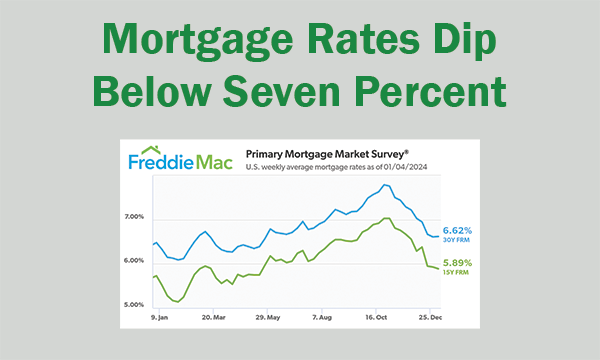

In a welcome turn for prospective homeowners and those considering refinancing, mortgage rates have dipped below the 7% threshold, as recently reported by Freddie Mac. This marks a significant shift in the housing market, offering a glimmer of hope in what has been a challenging economic landscape.

The Significance of Falling Rates

Mortgage rates are a critical factor in the housing market, influencing affordability and buying power. For much of the past year, rates have been on an upward trajectory, placing strain on buyers and dampening the overall demand for home purchases. However, the latest data indicates a downward trend, bringing relief and new opportunities.

Understanding the Drop

Several factors contribute to the fluctuation of mortgage rates. Economic data, inflation rates, policy decisions by the Federal Reserve, and global market dynamics all play a part. The recent decrease can be attributed to a complex mix of these elements, suggesting a possible cooling of inflation and a more cautious approach to interest rate hikes.

Implications for Borrowers

What does this mean for individuals and families looking to secure a mortgage? The drop below 7% opens the door to more favorable loan terms, potentially saving thousands of dollars over the life of a mortgage. It’s an encouraging sign for first-time buyers who have been priced out of the market and for existing homeowners who are considering refinancing options.

A Momentary Dip or a Lasting Trend?

While the current rates offer a moment of reprieve, the market remains unpredictable. Experts advise keeping a close eye on economic trends and staying informed through reliable sources like Freddie Mac’s Primary Mortgage Market Survey®. This vigilance ensures that potential borrowers can make timely, informed decisions.

Moving Forward

The decrease below 7% is a noteworthy event that may signal a shift in the economic winds. Those interested in how this affects their mortgage options should consult with a mortgage loan originator to understand the best course of action for their financial situation.

With careful consideration and strategic planning, the current rates can provide a significant benefit to borrowers, making now an opportune time to evaluate your mortgage needs.