After looking at what has happened in the real estate market and lending rates anyone can have a ‘head full of stump water’. I say this because historically, rates and property values have an inverse relationship. As rates rise, property values decline and vice-versa. But at the end of the day, your hidden danger lies in your monthly payment. The home prices are higher and rates increasing will make your monthly payment unbearable.

Rates usually don’t move until the week of the Fed’s decrease/increase. This time around the rates started to increase in January. That’s two months prior to any adjustments by the Fed. Not only that but it increases almost 2% before the rate hike.

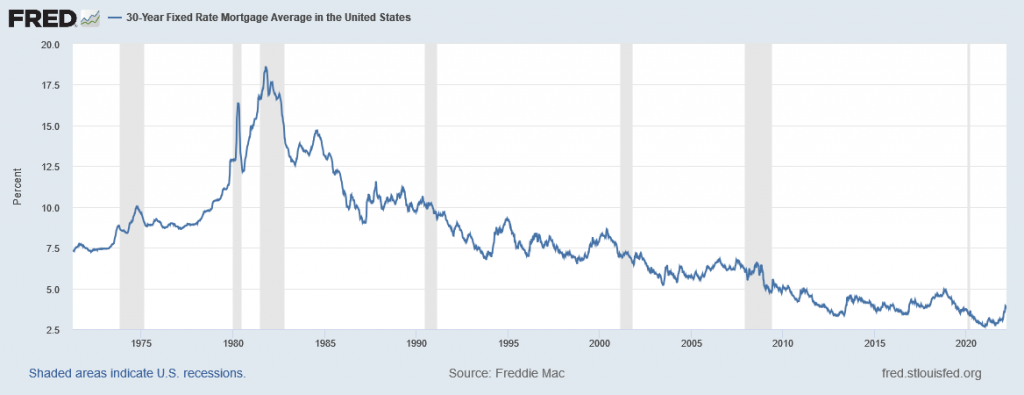

The good news! As you can see below even though rates went up, they are historically low. This presents still a good opportunity for all buyers. If you are in the market to refinance… don’t wait, do it now.

Another factor to consider as if the above was not enough, these past two years inflation has gotten out of hand, The cost of food, materials, services have skyrocketed. Not to mention automobile prices have easily gone up 20%. Gas prices have doubled. I’ll be the first one to say it … What happened in 2006-07 will not happen again. There may be small downward movements but prices are here to stay and I’m not referring to home prices only.

Don’t let your long-term goals be halted by emotional decisions because you will lose something more precious than money… time.

The real issue you may be facing is your monthly mortgage payment on purchases and or refinances. We have many solutions to help you with your high mortgage payment. Use your phone scanner below to either get in contact with us for an appointment or submit your online application while you are on the go or clink on the links to continue on your PC.