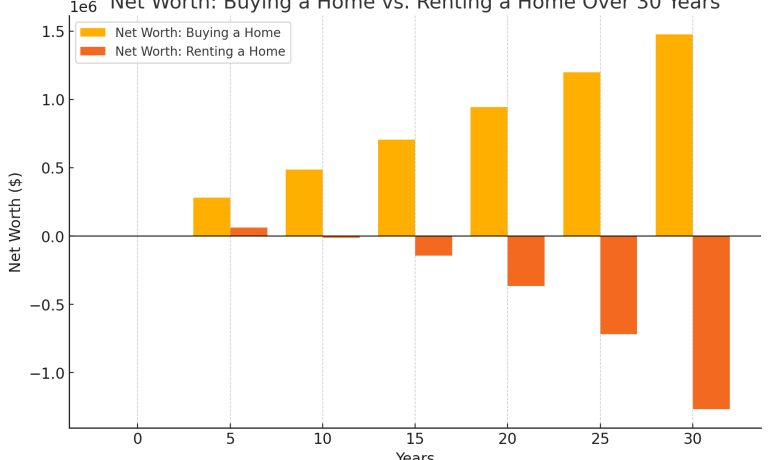

Above: The updated bar graph illustrates the net worth of an individual over 30 years when choosing to buy a home versus renting. This comparison shows how the net worth could evolve under both scenarios, taking into account home equity and investment returns. It provides a clear view of the potential financial outcomes based on these two different strategies.

When it comes to building wealth, the decision to buy a home versus renting can significantly impact your net worth over time. To help put this into perspective, let’s consider a few examples from everyday life. Thirty years ago, the cost of a gallon of milk was around $1.13, a dozen eggs were about $0.78, and a postage stamp cost only $0.20. Fast forward to today, and those same items cost much more: a gallon of milk averages about $4, a dozen eggs are around $3, and a postage stamp costs $0.66. Just as the cost of these everyday essentials has increased dramatically over the years, so too has the value of real estate and the cost of renting a home.

Buying a Home: A Pathway to Building Wealth

When you buy a home, you’re not just purchasing a place to live—you’re making a long-term investment. Over the last 30 years, homeowners have seen significant growth in their net worth due to property appreciation, building equity, and fixed mortgage payments that don’t increase like rent does. For example, a $500,000 home purchased today could appreciate by about 3% per year on average. After 30 years, the home could be worth over $1.2 million, assuming steady market conditions. Meanwhile, you’ve been building equity with every mortgage payment, increasing your net worth over time.

Renting a Home: A Different Financial Journey

On the other hand, renting a home means you are paying for the cost of living without gaining any ownership or building equity. If you started renting a similar property for $2,800 per month today, you’d face annual rent increases (typically around 3% per year). After 30 years, your monthly rent could increase to nearly $7,000. While renting can offer flexibility, it does not provide the same opportunities for wealth accumulation as homeownership. Rent payments do not contribute to your net worth—they are simply expenses that increase over time.

The Bottom Line: Why Buying Often Beats Renting

When considering your financial future, it’s important to understand how these choices impact your net worth. Buying a home can help protect you against inflation (much like owning assets in general), whereas renting leaves you vulnerable to rising costs without the benefit of equity growth. With homeownership, you’re investing in an asset that historically appreciates, while with renting, your money isn’t working for you in the same way.

Given the current market conditions and mortgage rates, now might be a great time to consider buying a home if you’re looking to build wealth over the long term. At MCL, we’re here to help you understand your options and find the best path forward for your unique financial goals.

Contact us today to explore your options and take the first step toward building a solid financial future!

Questions? We'll Put You On A Right Path!

Buying or refinancing can be a daunting task, let us give you the options that best benefit your needs.